Source: Art Business News.

There is no industry that has gone untouched by the widespread disruption of the coronavirus. The art world, like all other sectors, is quickly grappling with rapidly evolving challenges. Although there is no clear roadmap on how to move forward, the team at Huntington T. Block has seen a few trends among galleries, art dealers, collectors, artists, art fairs, and more that are smart to have on your radar.

The Evolving Gallery Scene

The prolonged closure of galleries across the country has forced art galleries and dealers to develop strategies for different ways to stay relevant, promote artists and run their business. For example:

- Online viewing rooms – Many art dealers have embraced digital technologies to stay connected with key cliental and artists during the pandemic. Although a majority of galleries already had established virtual platforms in place, online viewing rooms are being relied on even more now as an effective way to showcase artwork and engage collectors—whether it’s a major art fair like Art Basel Hong Kong or a small to mid-size gallery. In fact, viewing sites have almost become the norm as a replacement for art fairs that could not proceed. Obviously, these digital platforms do not allow potential buyers to experience art physically, but many collectors feel comfortable buying their works through reputable galleries from familiar artists.

- Financial support – Many small businesses in the art industry may potentially qualify for financial assistance through the federal government. The rapid and evolving changes around what help is available can be intimidating and overwhelming. Art dealers should feel empowered to seek out guidance from financial professionals to navigate any confusion or uncertainty about how to access, benefit, or qualify for government sponsored loans and grants or assistance.

- Employee relations – Art museums and galleries around the world have been faced with tough decisions—layoffs and furloughs—in response to the financial fallout. For example, the Museum of Fine Arts, Boston, recently furloughed about 300 staff members, more than 40 percent of its workforce. If possible, galleries should consider hiring freezes and salary cuts to help retain workers. The altruistic goal here being to help ensure that staff can weather this crisis as-best-as possible so, when the time comes, they may return to work on their feet.

Reactionary Selling

As the state of the economy worsens, art collectors may feel that it’s wise to sell their pieces. Financial professionals typically caution against reactionary selling during a financial crisis. My team and I, just like all fine art lovers, have a strong passion for art and fear the dangers of any type of commoditization. Fine art insurance aims to protect rare and historic objects to help guarantee their survival, in good condition, from one generation to the next—and over many centuries in some cases.

However, the general consensus among art dealers and art advisors, from my perspective, is that there is no mass desire to sell artwork at this time. Most collectors take a more conservative approach to the sale of artwork, which requires time and skill in order to optimize value for both the buyer and seller. Additionally, the high-end collector segment of the marketplace is somewhat insulated from immediate effect of the economic downturn.

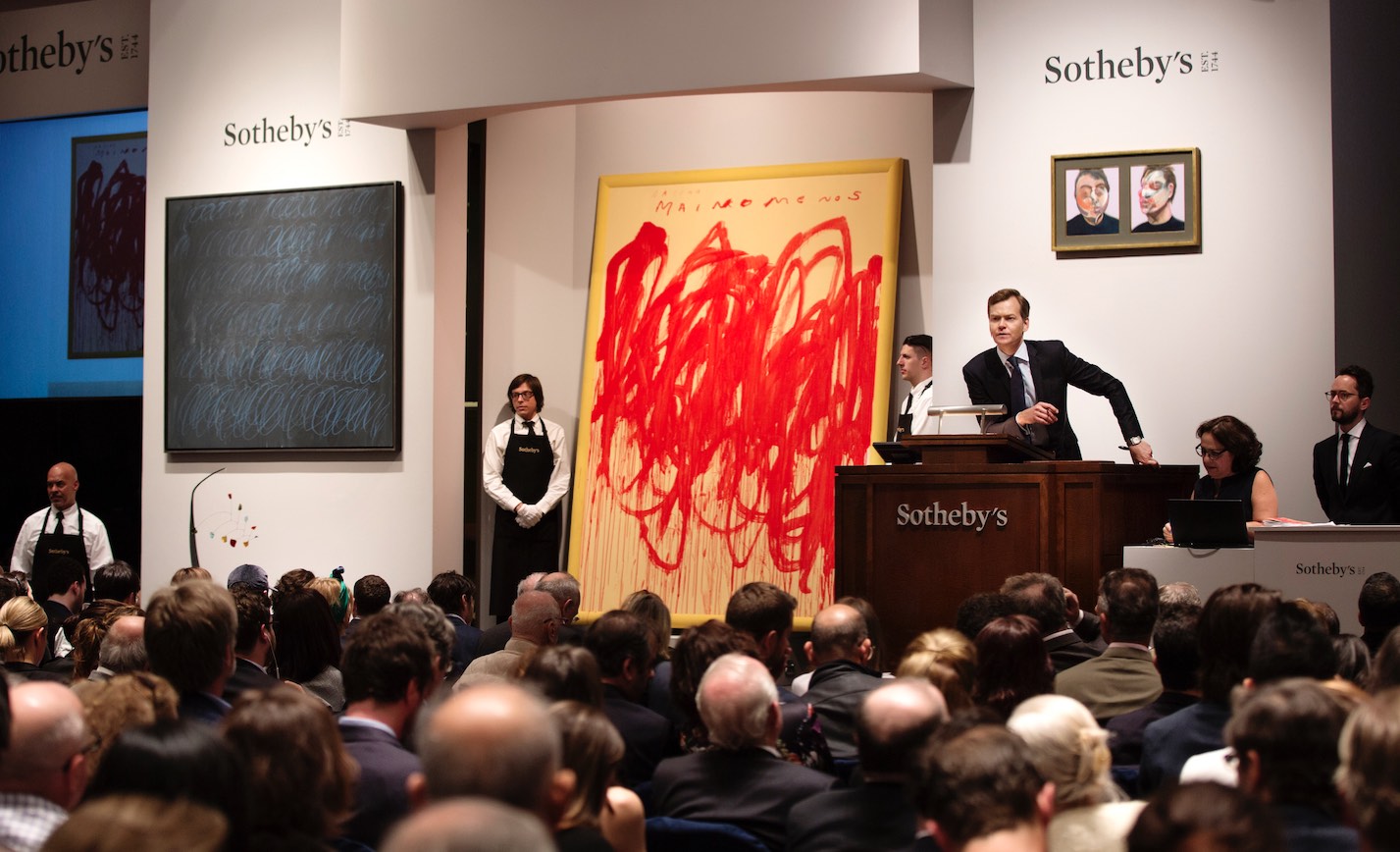

Auction Market

Several of the recently concluded auctions, particularly last fall, resulted in lower than expected sale totals. The sales were lower not due to a decrease in unit price per se. Rather, the decrease was tied to a lack of supply of high-quality pieces available for sale. It’s too soon to speculate what the art market conditions will be in one month, one quarter, or even one year from now, and beyond. However, it can be assumed that any current reactionary selling will not have a substantial impact on overall pricing in the future.

The current challenge with buying art is not financial, but rather logistical. As lockdowns continue, physical inspections of artwork and movement of pieces cannot occur—a critical aspect of the sale process. For the time being, many collectors are developing “wish lists” in the hope of investing in the artwork of established artists—this could be the result of the recognition of artwork as an asset class and confidence in the value of good artwork.

Managing estimates at auction will be the key to bringing in potential buyers. There are a lot of people who still have a lot of money. If there is good work available, I can see where the auction houses may work to appeal to the collectors’ desire for good value and be able to build interest and sales.

Looking Ahead

Overall, we must remember during these delicate times that this is not the first downturn in the economy that the art world will have lived through. Galleries, art dealers, collectors, artists, art fairs, and the industry as a whole need to support one another as we navigate these challenges.