Source: Medium.

New advances in machine learning may help us understand the obscure costs of fine art.

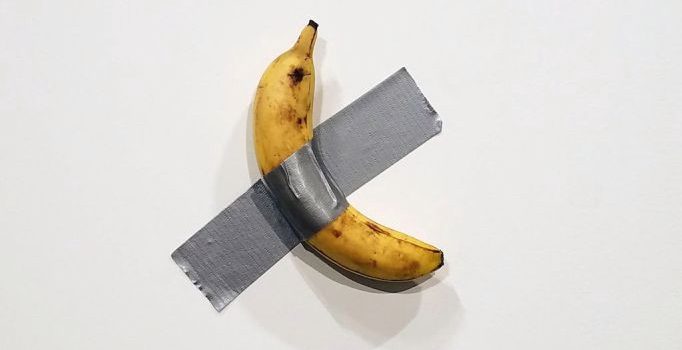

How much would you pay for this piece of art?

What? You could get some bananas and duct tape for a few dollars at the store? Well, anyone who didn’t duct tape their banana to a wall and sell it at an art fair would be missing out on a sizable payout of $120,000.

That’s right — in 2019, artist Maurizio Cattelan sold three editions of this banana for $120,000 to $150,000 per piece.

The sale of Cattelan’s piece underscores the unpredictability that is generally associated with the art industry. Art auctions often make headlines for their seemingly illogical prices, and critics are still baffled at what compels consumers to pay six figures for a banana taped to a wall.

As art auctions boasting unusual pieces continue to cause controversy, appraisers have sought ways to rationalize and predict the values of various artworks. With the growing popularity of artificial intelligence (AI) in different fields, AI may be the next step to stabilizing the art market.

Why the Price of Art Is Unpredictable

On the surface, several factors make the art industry appear so erratic. First, each piece of art is unique and highly individualized to the artist who produced it. Comparing the price of an oil painting to a duct-taped banana is like comparing apples to oranges, but worse.

Furthermore, a high-profile artwork may go decades between sales, making it near-impossible to obtain accurate price estimates. Take Leonardo da Vinci’s Salvator Mundi, which sold in 2005 for $10,000 (less than one-tenth of the price of the banana)… and was resold in 2017 for a whopping $450,300,000.

The market for prestigious art is also extraordinarily small, as only the immensely wealthy can afford to drop millions of dollars on artwork. As a result, it is difficult for most artists to gauge how much demand their work will bring.

When all of these aspects of the market are combined, prices appear to drift around arbitrarily, and from the perspective of human appraisers, this might be true. Based on results from two of the largest art auction houses, Christie’s and Sotheby’s, the accuracy of human art appraisals only averaged at about 37% to 41%. For the majority of artwork, even experts’ price predictions were disappointingly inaccurate.

What Makes Art Expensive

At first glance, one would think that the prettiest art would be the most valuable, right?

Wrong.

Experts have previously tried to use AI to predict the prices of art based on visuals alone. With convolutional neural networks, which already had applications in image recognition, art appraisers tried to anticipate prices based on aesthetics. However, when compared to models based on numbers and text inputs, visual models performed surprisingly poorly.

These models imply that the visual aspect of an artwork is not the determining factor in the value of the art. And, when you think about it, who could expect that someone would pay $6 million for a golden toilet based on the aesthetic alone?

Recent data actually suggests that the reputation of an artist is usually more important than how his or her art looks. A study that mapped out artists’ careers discovered that artists with early access to high-prestige galleries averaged sales of $193,000, while artists that had later access to prestigious galleries or remained low-prestige for their whole careers only averaged at around $40,000. Moreover, artists who started as low-prestige seldom managed to climb the ranks in the industry.

How Machine Learning Helps

We now know why art prices are so irregular and what makes certain artworks ridiculously expensive. AI can piece everything together to predict and stabilize the price of art.

In machine learning, computer algorithms learn and adapt to new data without human intervention. When given a set of sample data, algorithms can build models and make decisions without explicit instructions.

There are two main ways in which art appraisers have already used machine learning to price art.

1. A model used textual and quantitative data to appraise art.

For each artwork, the model analyzed the year of creation, the artist, and materials used to evaluate the piece. This machine learning model was fairly accurate, as it was able to inspect patterns between those features (i.e., how an artist uses their materials) to authenticate works of art. The model could detect patterns within artworks that were unnoticeable to the human eye.

2. Models used text analysis to evaluate artists’ social media presence.

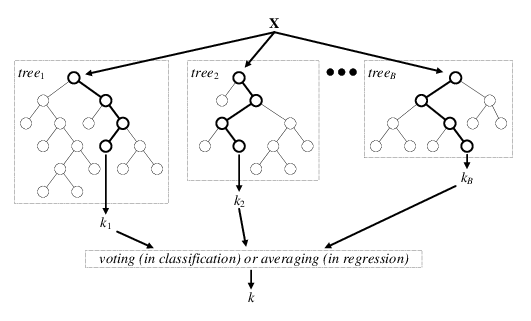

Using the social media strategy, appraisers used machine learning methods such as k-nearest neighbors, which classifies cases based on their similarities, and random forest models, which build decision trees for classification. These methods surprisingly found that making more sales was not contingent upon having a social media presence. However, among artists who were active on social media, word counts for artwork descriptions and artist biographies on social media directly related to sales success.

The first in-depth study using AI to gauge artists’ social media presence was only conducted in 2019, so the precise relationship between word count and profit is still unclear. However, current data has been sufficient for models to examine art more quickly and about as accurately as humans.

Two well-known art auction houses, Sotheby’s and Christie’s, have slowly begun to implement AI into their appraisals, although they still rely mostly on human evaluations.

Growing the Market

Models such as the ones described above have been improved over the last decade to improved the speed and frequency of appraisals. The automated evaluation of art could help expand the market as accessible appraisals allow for more transparency and market liquidity.

Current machine learning techniques for appraisal are only about as accurate as human appraisals, despite working much more quickly. However, the accuracy of AI appraisals is gradually improving. As technology advances, it is likely that the art market will become more accessible and transparent, and we may see more predictable patterns in the price of artwork.

TL;DR

- The lack of accessibility in the art industry results in unpredictable prices.

- An artist’s reputation is more important in sales than the aesthetic of the art.

- One machine learning model analyzed the patterns between non-visual aspects of art.

- A second model evaluated artists’ social media presences using two methods: k-nearest neighbors and random forest models.

- As AI improves, it could expand market liquidity and transparency in the art industry.

… And if anyone was still wondering about the banana, another artist ate it while it was still on display.