Source: Medium.

Millennial collectors are stepping into the spotlight, ushering in a new era of art appreciation and acquisition.

Evidence shows that younger individuals are displaying a keen interest in art collecting, while simultaneously reshaping the methods of art distribution. The 2020 edition of The Art Basel and UBS Global Art Market Report uncovered a compelling trend: High Net Worth (HNW) millennials are now the most rapidly growing group of collectors, outpacing all other demographics in terms of art purchases and expenditures.

In recent times, art galleries and auction houses have redirected their focus towards capturing the attention of millennials, individuals aged between 23 and 38, who are known for their constrained finances and time. So, the question arises: How can this younger audience be effectively engaged? Heather Flow, a New York-based art advisor with a millennial clientele, emphasizes precision as the key. She suggests that truly connecting with millennial collectors necessitates a fundamental reevaluation of transparency, flexibility, diversity, and sustainability within the gallery business model.

Millennial art buyers approach their collections through a lens that combines social and investment values. Just as the art preferences of the Baby Boomer generation in the 1960s and ’70s were influenced by societal and political changes, millennials’ choices are similarly shaped by the contemporary landscape.

While buyers aged between 40 and 64 still dominate the art market, constituting 62% of all buyers in 2019, there was a noteworthy 6% year-on-year increase in collectors under 40, bringing their share to 19%. Among these younger buyers, the contemporary art sector boasted the highest percentage, with 21% of collectors being under 40.

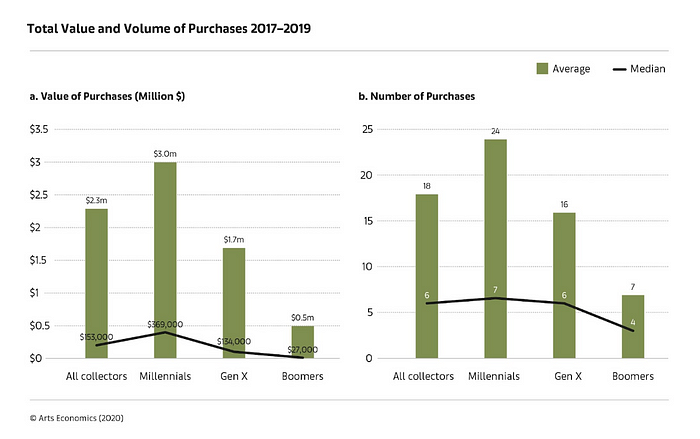

This shift is most pronounced among HNW collectors. McAndrew’s analysis revealed that millennials not only made the most purchases but also spent the most, averaging a total expenditure of $3 million over two years, a stark contrast to the spending habits of boomers. Notably, 69% of those spending over $1 million were millennial collectors, marking a substantial increase from 41% in 2018.

This generational shift has also brought about a gender shift. Female collectors reported significantly higher average expenditures compared to their male counterparts, with 34% of women spending over $1 million in the past two years, in contrast to 25% of men. This data suggests a correlation between the rise of female collectors and the millennial segment, underscoring the significance of female collectors within this demographic.

Surveys of more than 1,300 HNW collectors conducted by Arts Economics and UBS Investor Watch in seven markets (the US, UK, France, Germany, Singapore, Hong Kong, and Taiwan) indicated that millennial collectors purchased the most and spent the most.

Surveys conducted by Arts Economics and UBS Investor Watch across seven markets revealed that millennial collectors consistently ranked highest in both art purchases and spending. Notably, younger collectors are the driving force behind the art world’s digital migration, evident in the proliferation of new digital platforms, from Instagram-only galleries to Art Basel’s Online Viewing Rooms. In the survey, a striking 92% of HNW millennial collectors reported making online art purchases, in stark contrast to less than half of boomers. Instagram, in particular, emerged as a critical marketing tool, cultivating interest and confidence in artists and galleries. While the majority of millennials incorporated Instagram into their art collection process, nearly three-quarters of boomers had never used the platform for art purchases.

Furthermore, the millennial generation has been shaping the art world to align with their technological habits. Unlike their older counterparts, millennials use digital tools extensively for art consumption. Instagram, among the various social platforms embraced by millennials, has become a vital marketing tool for artists, galleries, and collectors seeking to acquire new artworks. The art market, it appears, no longer hinges solely on physical spaces but rather thrives through multi-channel art consumption, a trend spearheaded by millennial art buyers. Notably, among online buyers in 2020, millennials constituted the largest share of high spenders, with 14% having spent over $1 million, compared to a mere 5% among boomers. Moreover, millennials expressed increased interest in art during the pandemic, with 60% of them exhibiting confidence in the market’s performance for the upcoming year, as opposed to a meager 24% of boomers.

Looking ahead, the influence and purchasing power of millennials are poised for further growth as they inherit both wealth and art collections from their elders. According to dealers surveyed by McAndrew, modern collectors tend to diversify their collections, source art from multiple channels, and are willing to sell pieces that no longer align with their tastes. This shift is likely to foster greater fluidity within the art market as it transitions into the hands of the younger generation.

Heather Flow aptly describes millennial collectors’ connoisseurship as predominantly community-driven. This shift is compelling institutions to reevaluate traditional exhibition methods and embrace a more innovative, flexible, and diverse approach.

In summary, millennial art buyers have emerged as a formidable force in the art market, characterized by their remarkable growth in purchases and spending. The 2020 edition of The Art Basel and UBS Global Art Market Report underscores their prominence. However, one must delve deeper to understand who the millennials are, what motivates them in the art investment arena, and how their increasing importance is catalyzing a long-anticipated digital revolution.

Notably, millennials are savvy investors, as revealed by a study conducted by the US Trust. They are twice as likely as boomers to view art as a financial asset, effectively blurring the lines between collectors and sellers. Yet, financial gain is not their sole motivation; millennials are equally driven by the social impact of their investments. During the pandemic, 68% of millennial art buyers, participating in The Art Basel and UBS Global Art Market study, expressed their commitment to supporting artists, further demonstrating the multifaceted nature of their art investments.

In conclusion, the pandemic exposed the digital divide within the art market, prompting the emergence of Generation Z and heralding the long-awaited digital revolution. This shift has led to a substantial increase in online presence for artists, galleries, buyers, and collectors. The art market’s future is imbued with a sense of optimism, primarily driven by millennials, 60% of whom are confident about the market’s performance in the upcoming years, in stark contrast to the cautious sentiment expressed by only 24% of boomers. Indeed, it appears that the torch is being passed to the millennials, and we’re inclined to side with their vision for the future of the art market.