Source: Artsy.

Welcome to the 2024 edition of Art Industry Trends, Artsy’s annual research-driven report on the key topics shaping the gallery landscape today.

This year, we surveyed gallery professionals from 68 countries to discover the main factors affecting their businesses in 2024—from discounting practices, to collector behavior, to the artists driving the most sales.

This year’s report arrives against the backdrop of a tricky environment for the art trade. Interest rates and inflation remain stubbornly high across advanced economies, with many still impacted by slow growth that marred much of 2023. For galleries, this was felt most acutely in the form of rising business costs. In light of this, our survey respondents reported participating in fewer art fairs and noted that online marketplaces are key to their businesses, both for meeting new collectors and making sales.

In terms of sales, our report finds a stable picture. Most galleries across all sectors reported roughly the same or increased sales in 2023 compared to 2022. And despite talk of galleries offering larger discounts to appeal to choosier collectors, a majority of respondents offered discounts on less than half of their sales last year. The highest proportion of respondents also said that they had experienced no change in their sales cycle timelines, countering anecdotal evidence that collectors are slower to make sales decisions than before.

The picture overall from this report is that galleries are approaching the current challenges in the art market with resiliency. We thank the respondents who took part in this year’s survey, and hope that the insights provided in this report serve you well.

Here, we share an abridged version of the report. Read the full analysis by downloading Art Industry Trends 2024.

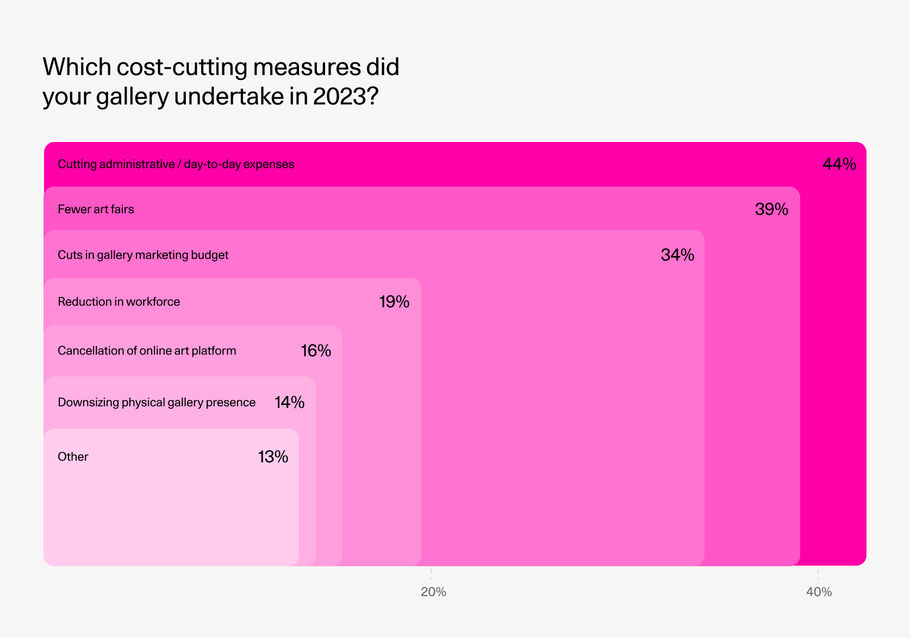

1. Nearly half of galleries implemented cost-cutting measures to increase profitability in 2023.

Based on Artsy survey data.

Almost half of respondents (48%) have taken cost-cutting measures. Of those respondents, notably, 39% said that they are doing fewer art fairs. The cost of participating in art fairs was among the main themes of Artsy’s inaugural Art Fair Report from earlier this year, where a majority (56%) of surveyed galleries that do not participate in art fairs said that the cost of participating in fairs was the highest barrier to entry.

When asked to select how they are finding savings, 44% of respondents reported cutting day-to-day administrative expenses, followed by marketing budgets (34%), and a reduction in workforce (19%). Of those who reduced their workforce, the highest proportion (50%) said that gallery assistants were the positions they cut.

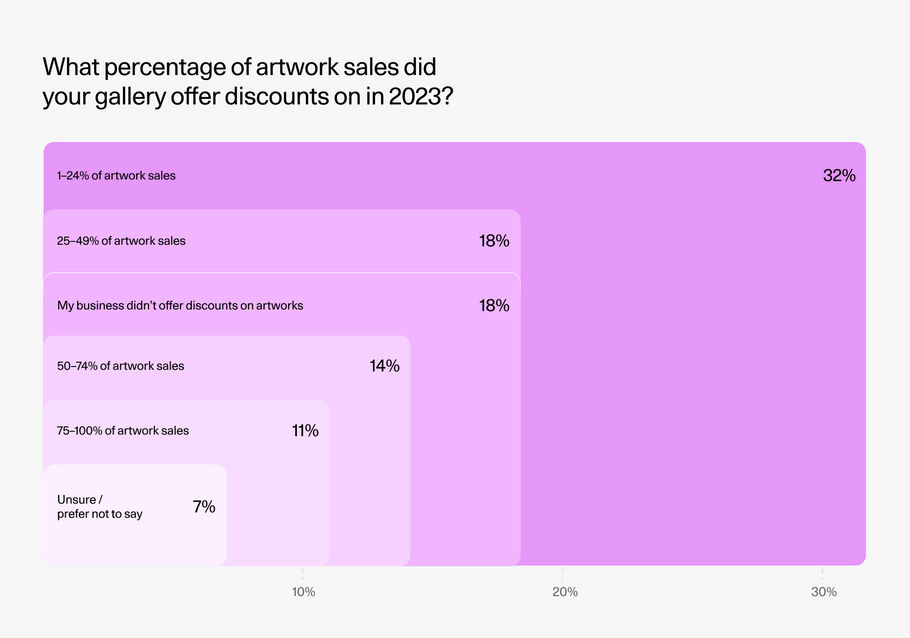

2. Half of galleries offered discounts on only some of their sales in 2023.

Based on Artsy survey data.

Half of our respondents reported that their galleries offered discounts on less than 50% of the artwork sold in 2023, with 32% saying that they offered discounts on less than 25% of works, followed by 18% that said they offered discounts on 25–49% of sales. Just a quarter said that they offered discounts on more than 50% of their artwork sales, and 18% said they didn’t offer discounts at all.

According to the largest proportion of respondents who offered discounts (36%), the average discount on artwork sales was 10–14%; 28% said their discounts were less than 10%; 19% said they offered 15–19% discounts; 5% said they offered discounts of 20–29%; and 2% offered discounts of more than 30%. These responses broadly mirror the Artsy data gathered for Art Basel and UBS’s report The Art Market 2024, which showed that the average discount for works sold on Artsy in 2023 was 18%.

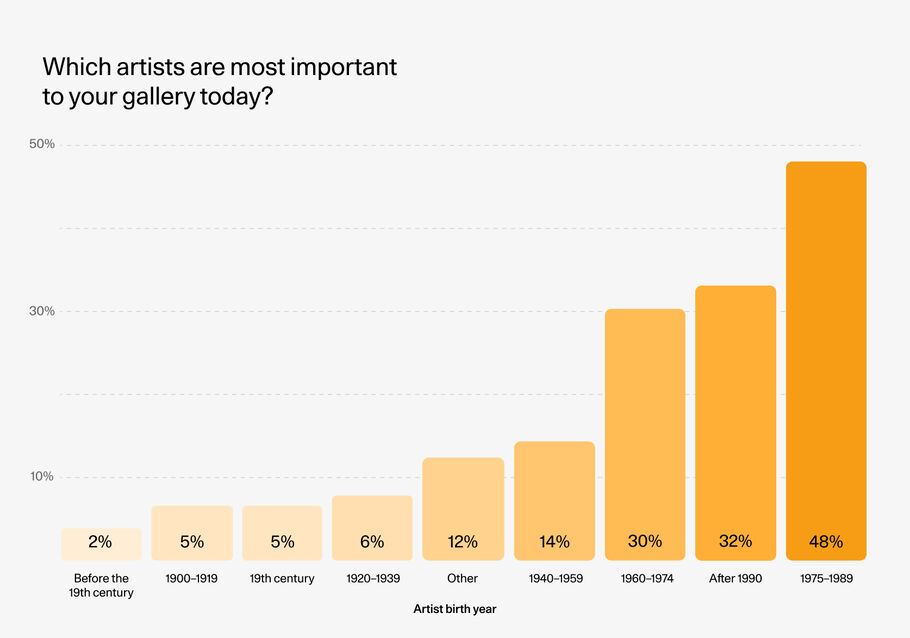

3. Ultra-contemporary artists are most important to most gallery businesses.

Based on Artsy survey data.

This data is commensurate with current interest in artists from the ultra-contemporary cohort. The rise in prominence of such artists has been one of the key themes from recent years in the art world, with a slew of blockbuster gallery representation announcements, headline-grabbing auction results, and museum shows for younger generations of artists becoming increasingly commonplace. Ultra-contemporary artists also dominated the list of most in-demand and trending artists on Artsy we published last year in The Art Market Recap 2023.

This emphasis on the ultra-contemporary cohort—which encompasses the vast majority of young and emerging artists working today, whose works tend to sell at lower price points—is reflected in the prices of artworks that galleries view as most important to their business. Asked to identify the two most important artwork value segments, most respondents (39%) selected the $5,000–$10,000 range, and under $5,000 (39%).

4. Most galleries co-represent artists with other galleries.

Based on Artsy survey data.

But joint gallery representation across a globalized art market is not a novel concept, our survey shows. Some 64% of respondents whose galleries represent artists said that they co-represent artists with other galleries.

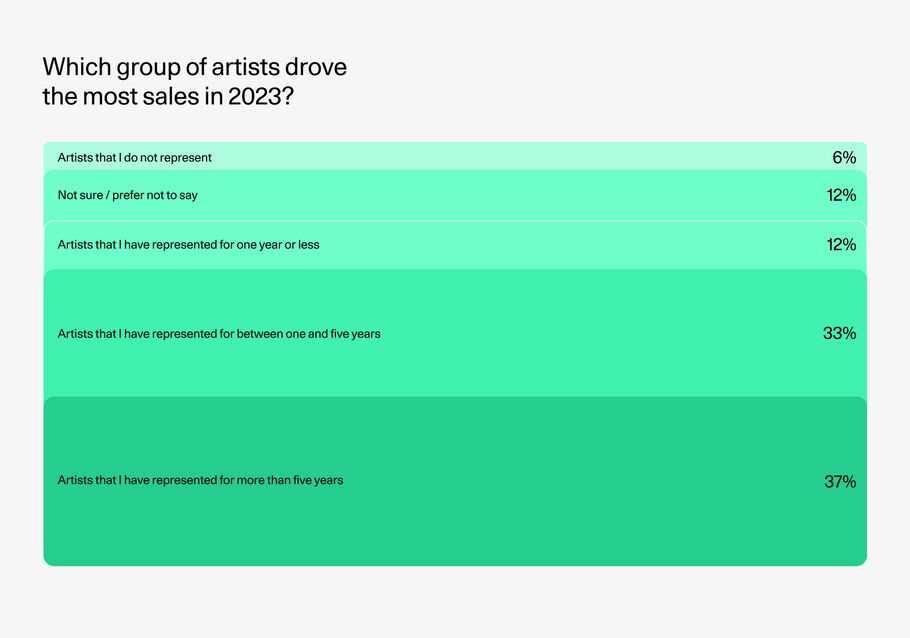

Unsurprisingly, represented artists are driving the most sales for galleries that have a roster of represented artists. The largest proportion (37%) of these respondents say that artists they have represented for more than five years drove the most sales for their gallery in 2023, followed by artists they have represented for between one and five years (33%). When asked what proportion of represented artists make up the most of their gallery sales, the highest percentage (30%) of respondents said that less than 20% of their represented artists constitute the majority of their sales, followed by 75–100% of their represented artists (19%).

Galleries that participated in this report illustrate a broad spectrum of the industry: Of respondents who represent artists, 33% represent fewer than five artists, followed by more than 21 artists (24%) and between two and 10 artists (22%). Most (46%) took on only one or two artists last year, followed by three to five new artists (28%). This is consistent with these respondents’ expectations for 2024: Most (40%) plan on taking on one or two artists in 2024, followed by three to five (26%).

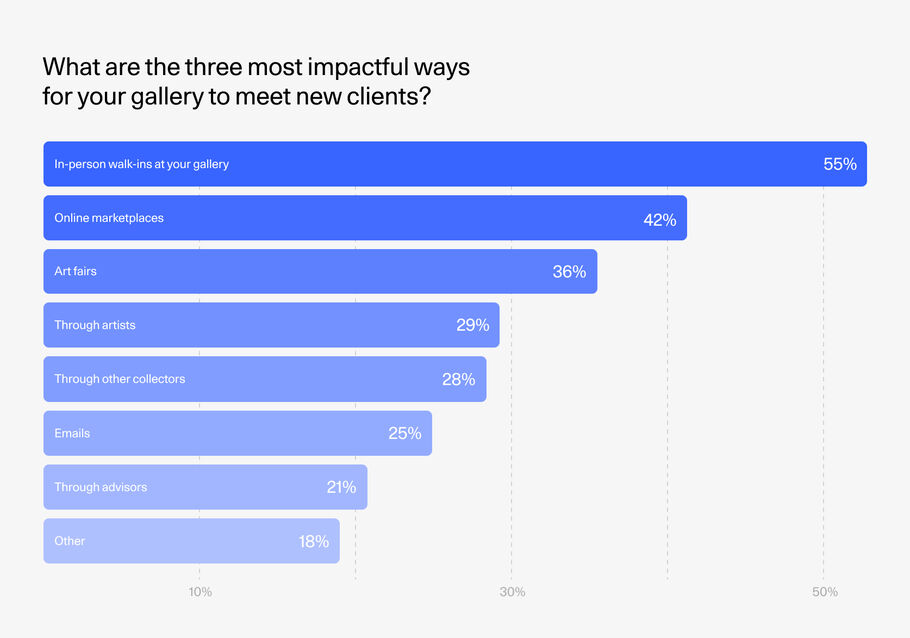

5. Online marketplaces outrank art fairs as an impactful way for galleries to meet new clients.

Based on Artsy survey data.

This picture changes slightly among larger galleries, where online marketplaces outrank all other channels as the most impactful means of meeting new clients. The option was selected by 73% of these respondents, more than art fairs (45%), art advisors (45%), emails (27%), and in-person walk-ins at galleries (27%).

When asked to select the methods that are a growing source of artwork sales for their business, most large galleries (54%) selected online marketplace / e-commerce, followed by art fairs (38%). This contrasts with what we found among smaller galleries—identified as having three or fewer full-time employees—where 26% said that online marketplaces were a growing source of artwork sales. Among this group, in-person conversations (39%) and email conversations / sending PDFs via email (35%) ranked at the top.

In terms of online sales, the picture is largely one of overall stability. For large galleries, the same percentage of respondents (44%) reported that online sales in 2023 had risen or stayed the same compared with 2022. For smaller galleries, the majority reported that online sales had either stayed the same (37%) or increased (28%), but a higher percentage (23%) said that their online sales had decreased.

When it comes to marketing, physical and digital channels are viewed on a broadly equal footing, confirming the hybrid state of the post-pandemic art world. Galleries across all groups said that email newsletters and in-person events are the most important marketing channels, with each option being selected by 51% of respondents when asked to identify up to three of their most important channels. This is followed by gallery websites (37%), online marketplaces (32%), organic social media (31%), and in-person art fairs (25%).

Methodology

Art Industry Trends 2024 was developed through an online survey that ran from April to May 2024, with responses from 716 gallery professionals and dealers who are both partners and non-partners of Artsy. The majority of participants (42%) are based in the U.S., followed by the U.K. (10%). Some 16% have been in business for less than three years, 40% have been in business for three to 15 years, and 44% have been in business for more than 15 years. Some 68% of respondents have a permanent, physical location. Large galleries are defined as having 25 or more full-time employees, and small galleries are defined as having three or fewer full-time employees.

Thank you

This survey would not have been possible without the gallerists, art dealers, and other gallery professionals who took the time to respond to our survey. We would like to express our gratitude, and hope that this report serves you well.