Source: Artsy.

Who are these online art collectors and how can the industry better serve them? This report unpacks the similarities and differences between online collectors’ spending patterns, motivations, and challenges, and compares them to those of traditional art buyers. It confirms some perceptions about online buyers and shatters others.

Artsy’s survey identified several key facets of online art buyers, which combine to support a positive outlook for growth in the online market as millennial and Gen-Z buyers reach their peak earning years.

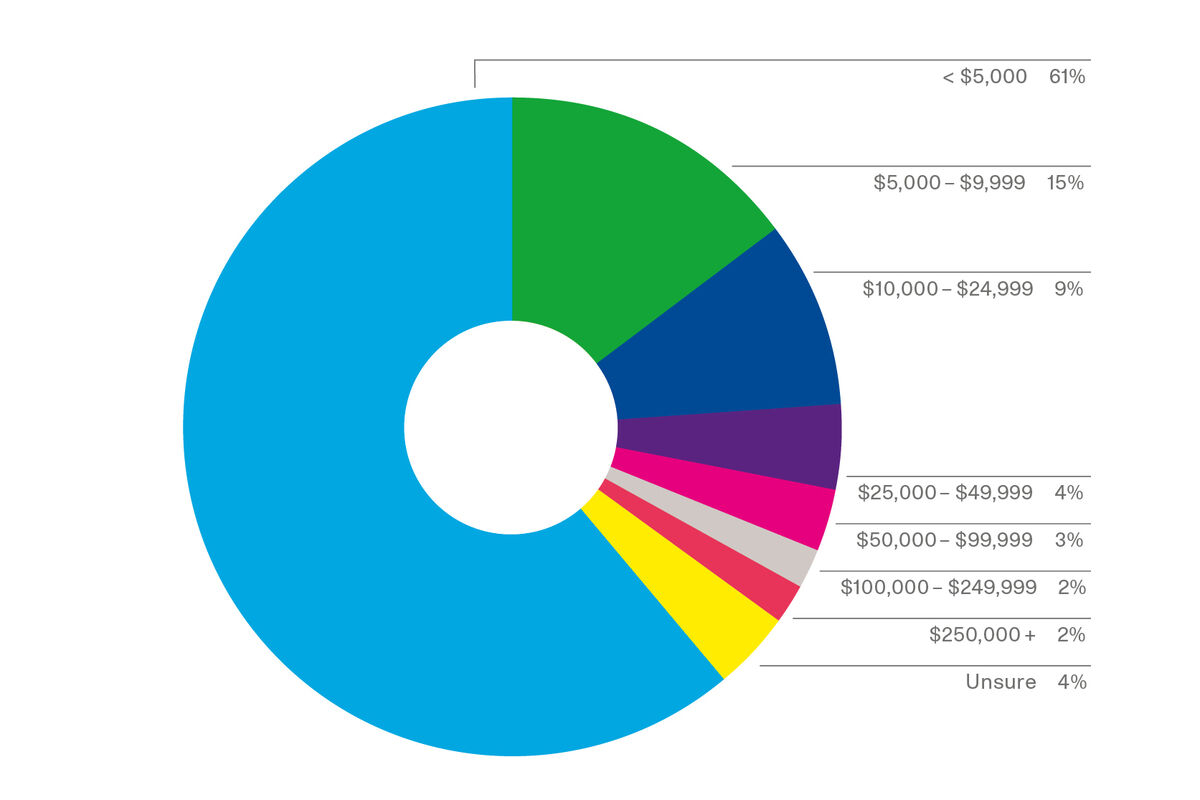

Collector budgets

Respondents to Artsy’s survey reported having annual art budgets that are equal to or marginally higher than those reported in a previous survey of American collectors conducted by Arts Economics and UBS for all but the highest budget buckets; a majority 53% of Artsy survey respondents who collect art said they are based in the U.S. This debunks a common perception that online art collectors are lower spenders compared to the collecting population as a whole.

The majority of collectors surveyed (61%) reported spending less than $5,000 annually on art—both online and offline—in each of the past 3 years (buyers were asked to estimate their expected budget for 2019), compared to 69% of respondents spending less than $5,000 over a 2-year span in the UBS and Arts Economics survey of high-net-worth individuals (HNWIs) with non–real estate assets of $1 million or more.

How much collectors spent on art annually (2017–2019)

Artsy survey respondents were found at consistently higher concentrations than the comparison survey within mid-range budget level:

- 15% of Artsy survey respondents reported spending between $5,000 and $10,000 on art annually, versus 13% over 2 years of spending in the comparison survey.

- 13% of Artsy survey respondents reported spending between $10,000 and $50,000 on art annually, versus 7% over 2 years of spending in the comparison survey.

- Just over 5% of respondents to Artsy’s survey said they spend between $50,000 and $250,000 on art annually, versus 5% over 2 years of spending in the comparison survey.

Collectors in the Arts Economics and UBS survey did have more significant concentrations at the extreme high end of the market, with 2% of their respondents spending over $1 million across the 2 years leading up to the survey, compared to 2% of Artsy survey respondents spending over $250,000 annually on art.

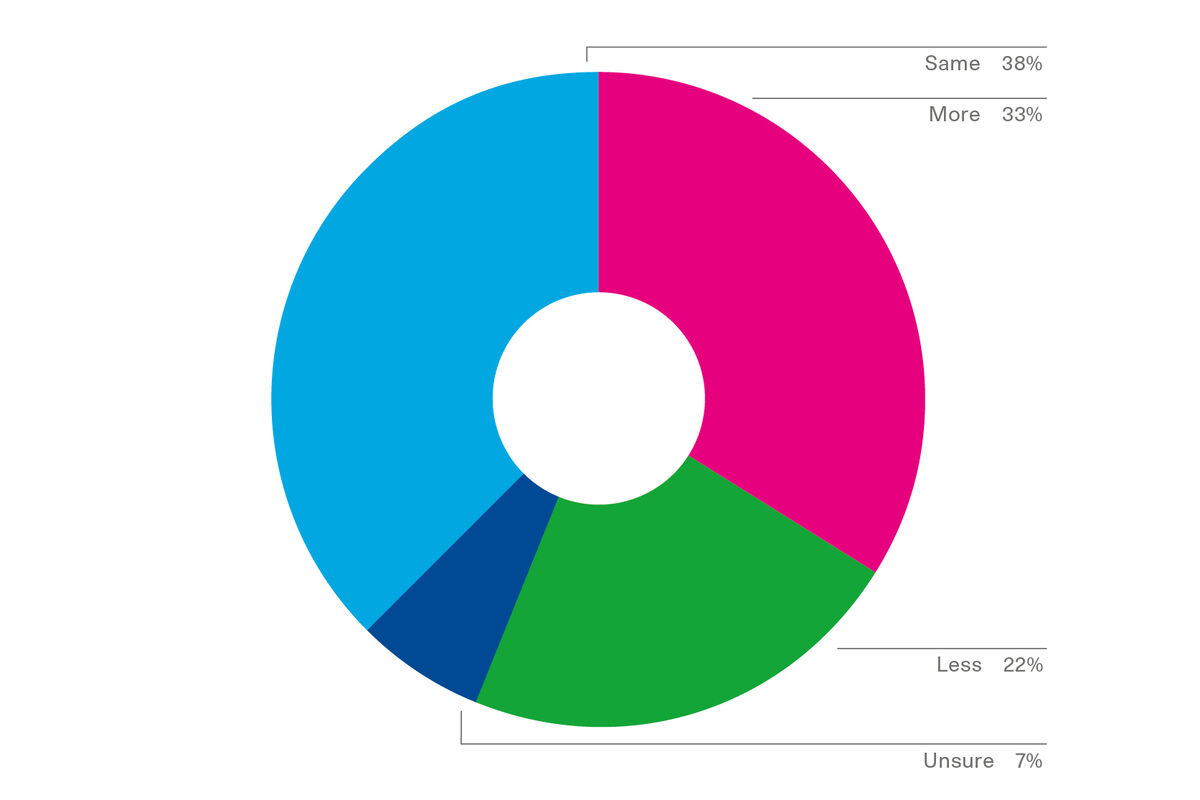

Budget trends

Collectors’ budgets remained roughly flat across the period. This is consistent with gains in the market over the past several years having concentrated among galleries with annual turnovers in excess of $1 million. Those high-value sales have pulled up the market overall, but median sales by dealers fell in 2018 by 5%, according to the most recent edition of Art Basel and UBS’s annual report, “The Art Market.”

However, there is upward movement within the lowest budget groups, with 4% of collectors who spent less than $5,000 in 2017 and 2018 expecting to increase their budgets to figures between $5,000 and $10,000 this year, and 3% of collectors having made that jump between 2017 and 2018.

Volume of purchases

A majority of collectors (57%) reported buying 1–2 artworks per year. However, survey-wide, collectors reported purchasing an average of 8 artworks annually. By comparison, American collectors surveyed by Arts Economics and UBS in 2017 averaged 2 artworks per year for those with less than $5 million in assets, and 4 artworks per year for those with assets in excess of $5 million.

How many artworks collectors buy annually

In Artsy’s survey, the number of artworks that collectors reported purchasing annually rose dramatically by budget. Collectors spending less than $5,000 annually on art reported buying an average of 2 works per year, while collectors spending $250,000 or more reported buying an average of 17 artworks per year, with 43% of these collectors buying more than 20 artworks per year (to calculate the average, this bucket was assumed to max out at 40 artworks).

Ten percent of collectors who have purchased art online in the past reported purchasing an above-average 10 or more artworks per year, compared to just 3% of collectors who have not purchased art online. Collectors in the latter group were found to be 36% more likely to purchase just 1–2 artworks per year than online art collectors.

These results suggest that online art collectors are more likely than art collectors as a whole to increase the volume of their purchases as their budgets grow, rather than simply buying the same number of artworks at higher price points. As a result, online art collectors have a more diffuse impact on the art ecosystem, and may be more difficult to service for individual galleries and auction houses than collectors who purchase single, high-value works.

Collector experience level and potential long-term value

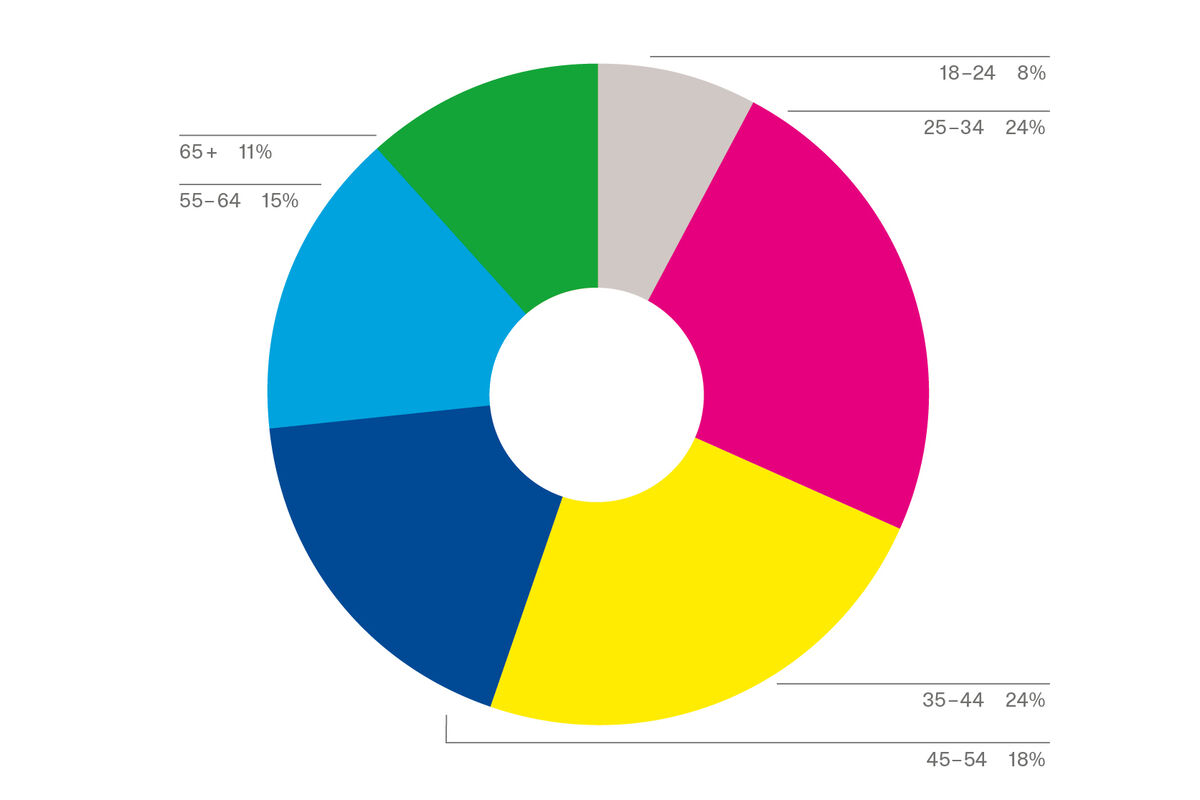

Most survey respondents were relatively new to the art market. Less than 50% of survey respondents have been collecting for 10 years or more, and 18% of current buyers said they have been collecting for 2 years or less. Thirty-two percent of respondents who actively collect online were under 35 years old—a key demographic for the art market, which currently needs to attract new buyers to support its artists, galleries, and auction houses.

Age of online art collectors

Nonetheless, collectors who have been buying for longer periods tend to have higher budgets. Seventy percent of those who reported spending $250,000 or more in 2018 said they have been collecting for more than 10 years, while an additional 22% have been collecting for 5–9 years. A similar pattern can be observed in collectors who reported spending between $100,000 and $249,000 in 2018. More than 50% of collectors who spend $5,000 or more on art annually have been collecting for at least a decade.

That pattern varies slightly when viewed by collectors’ ages. Budgets peak between the ages of 45 and 54, and then begin to recede again. This suggests that online art collectors are most active during their peak earning years, and are less inclined to use accumulated wealth to maintain a high art budget as they approach and enter retirement.

Online spending

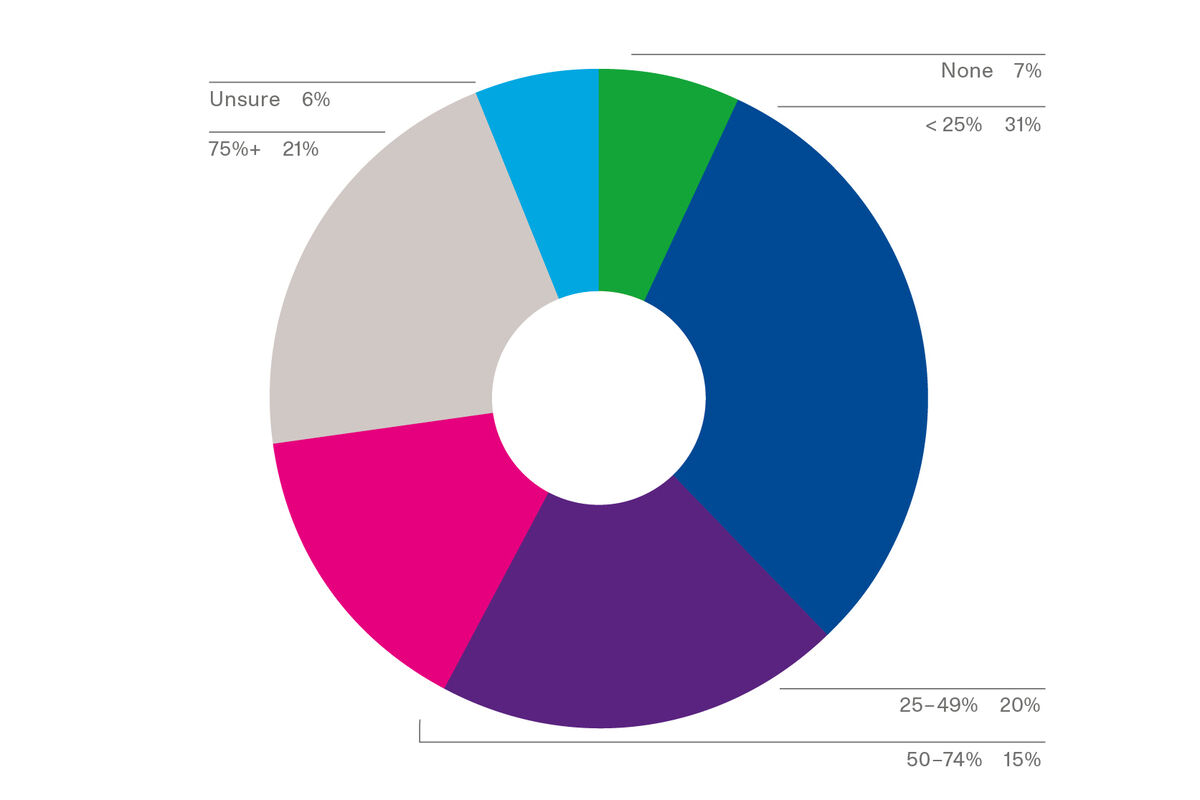

Portion of collectors’ art budgets spent online in 2018

Nearly two-thirds of collectors surveyed (64%) said that they have purchased art online in the past. Among these online buyers, 21% reported spending 75% or more of their annual art budget online, and another 15% reported spending 50–74% of their budget online (budget did not significantly influence the share of collectors’ art spending that occurred online). This is a sea change from several years ago, when the art industry questioned whether online platforms would be a viable purchasing channel for art collectors.

Portion of collectors’ art budgets spent online in 2018, compared to previous years

Length of time collecting

Budget

Other purchase channels

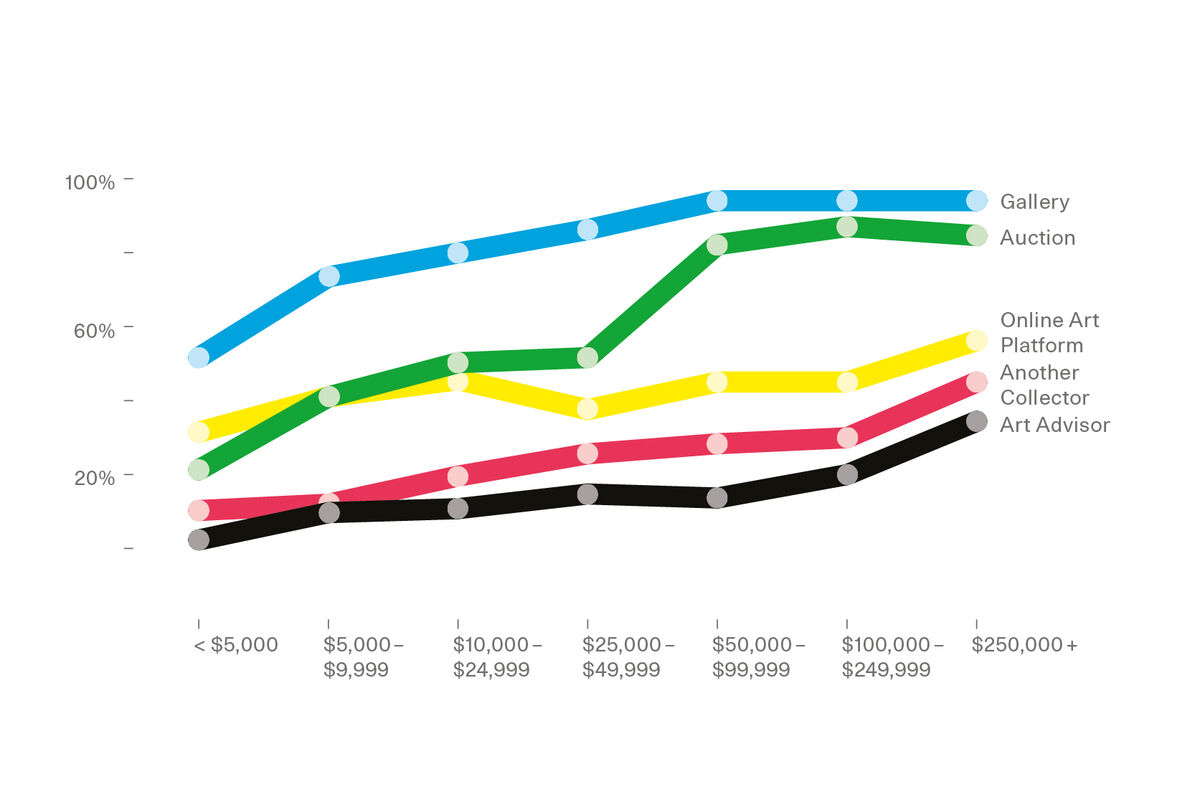

Artwork purchase channels that trend upward with budget

Collectors spending less than $5,000 annually on art were most likely to say they had purchased art directly from artists or during open studios, a tendency that declined as budgets increased. All other budget cohorts were most likely to have transacted through a gallery. Those with budgets greater than $50,000 over-indexed in their propensity to buy art through auction houses.

Despite their seeming ubiquity in the art world, art advisors were cited as the least common means of collecting. Less than 20% of collectors with budgets lower than $250,000 reported transacting through art advisors. Those with annual budgets greater than $250,000 said they use art advisors at a significantly higher rate (34%). However, this is still half of the rate that they reported collecting directly through auction houses and galleries.

Artwork purchase channels that trend downward with budget