Source: Artnet.

The art market, while still top-heavy, defied much of the ongoing global and economic volatility in 2022.

There are a number of surprisingly upbeat findings about the global art market—and varying degrees of country-specific, post-pandemic rebounds—in the latest UBS Art Basel Report, authored by cultural economist Clare McAndrew.

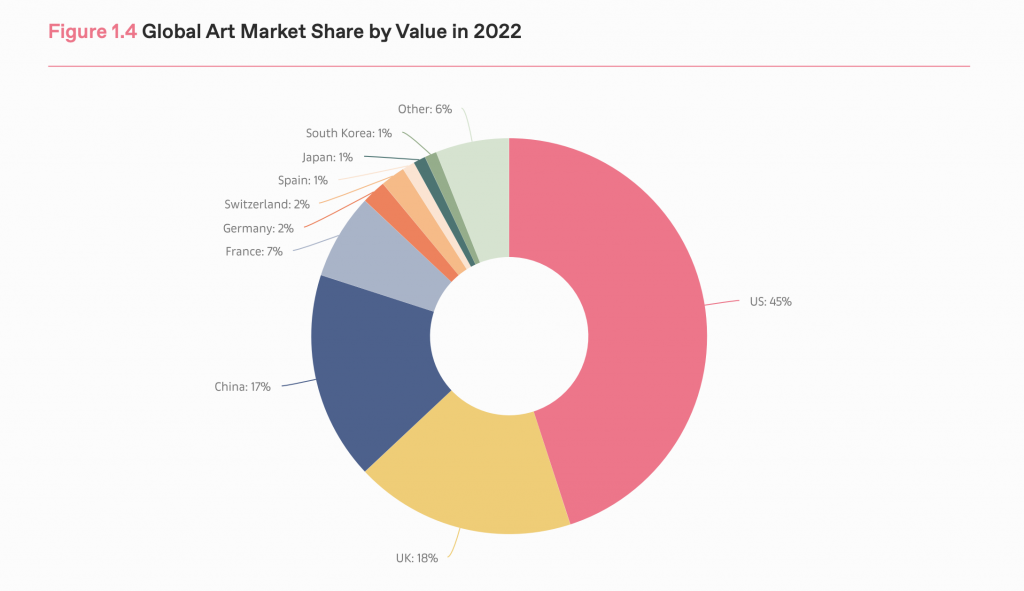

The data shows that the U.S. art market in particular has fared quite well, as has the U.K.’s—a fact some may find surprising, given all the talk of Brexit-related volatility and uncertainty in recent years—while the art market in China was hit with lockdown-related pressures, including canceled sales and events.

According to comments from Christl Novakovic, CEO of UBS Europe SE and head of wealth management for Europe, 2022 “saw the art market hold onto its post-pandemic rebound and strengthen further despite severe economic uncertainty and the return of war to Europe.” Even as financial markets slumped, collectors remained committed to buying art and reengaged with live events while exhibitions, auctions, and fairs returned to fuller schedules. Novakovic added, “This cautious growth in the face of deep uncertainty is testimony to the strength of the post-pandemic art market and reason to believe in its resilience.”

Along with the usual breakdowns of auction sales, dealer sales, and leaders by region, McAndrew also took a look at NFTs (nonfungible tokens) for the second consecutive year in a row, using data supplied by NonFungible.com.

Art Basel CEO Noah Horowitz, in an essay accompanying the report, wrote: “In an ever more quantified, yet also ever more complex world, the merits of data-driven analytics in supplying transparency in the art market is paramount, and this latest report provides a clear view on how the industry has fared.”

Here are seven key takeaways from the report.

1) Global Art Sales Ticked Up, But Not as Dramatically as They Did in 2021

Image courtesy of Arts Economics and UBS.

Total global art sales increased by 3 percent, to an estimated $67.8 billion, bringing the market higher than its pre-pandemic level in 2019, according to the report. After a strong 31 percent recovery in 2021 from the low point in 2020, results were more mixed in 2022, with variations in performance by sector, region, and price segments resulting in more muted growth.

2) Winners Take All in a Top-Heavy Market

The high end of the market continued to be the driver of growth in 2022. Sales in the public auction sector dipped slightly by 1 percent, to $26.8 billion. Of this total, the only segment to see growth was that for works priced over $10 million, no doubt fueled by record-setters like the Paul Allen auctions at Christie’s. The dealer sector grew by 7 percent, to $37.2 billion, and sales for those operating at the higher end were significantly better than their peers in the lowest tiers.

Image courtesy of Arts Economics and UBS.

3) The U.S. Guards Its Market Share

The U.S. retained its premier position in the global standing, with its share of sales by value inching up by 2 percent year-on-year, to 45 percent. The U.K. moved back into second place with 18 percent of sales, and China’s share dropped by 3 percent as it fell back into third position with a 17 percent share. Maintaining its fourth place is France, where many galleries, including from the U.S., have opened outposts in the past few years. Riding an updraft from 2021, the country—which saw the debut of Art Basel’s Paris+ fair in 2022—notched a new high of $5 billion, despite deteriorating euro values. The E.U. as a whole advanced by 5 percent year-on-year to an estimated $8.8 billion.

4) The U.K. Proves Surprisingly Resilient

Despite a year of intense economic and political pressures, sales in the U.K. maintained momentum, with a rise of 5 percent, to $11.9 billion in 2022. This second year of growth revived the market from its 2020 low, although sales were still below their pre-pandemic level in 2019 of $12.2 billion.

5) A Rough Year for Asia

China, including Mainland China and Hong Kong, had a significantly worse year in 2022, with lockdowns stalling activity, and sales and events curtailed or canceled. After reviving in 2021, sales declined by 14 percent year-on-year to $11.2 billion, and while this figure still bested 2020 by 13 percent, these two years notched the market’s lowest levels since 2009.

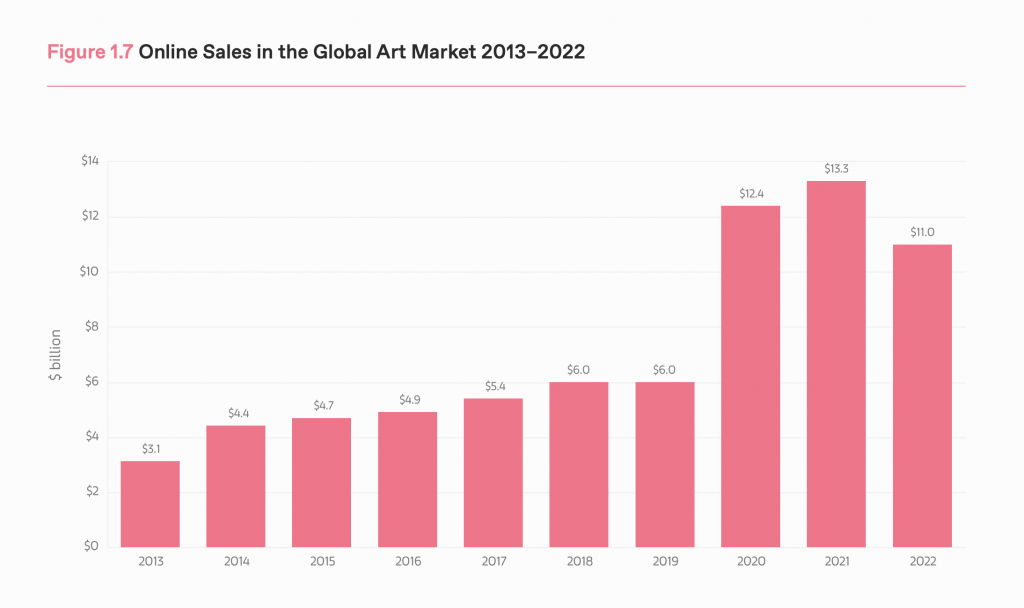

6) E-Commerce Dipped as the IRL Art World Returned in Full Force

Image courtesy of Arts Economics and UBS.

Exhibitions, auctions, and fairs all ran on much more robust schedules last year, as collectors began to reengage with live events and sales. Not surprisingly, dealers and auction houses alike reported a fall-off in e-commerce in 2022: Online-only sales slipped to $11 billion, a decline of 17 percent from the 2021 peak of $13.3 billion, but still 85 percent higher than in 2019. Online sales accounted for 16 percent of the total value of the art market’s 2022 turnover, down from a peak of 25 percent in 2020, and 4 percent lower than the share of global retail e-commerce, which stood at 20 percent in 2022.

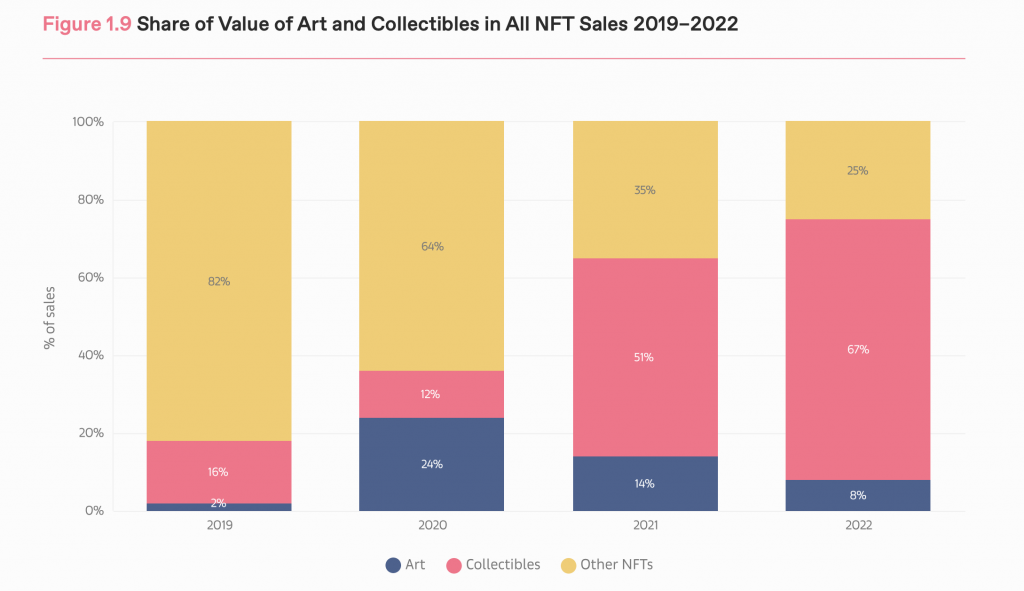

7) NFT Sales Drop By Half, and Art-Related NFTs are Particularly Hard Hit

Image courtesy of Arts Economics and UBS.

After hitting a peak 2021 of close to $2.9 billion, sales of art-related NFTs on platforms outside the art market fell to just under $1.5 billion, according to the report, a drop of 49 percent year-on-year. Despite the decline, sales were still over 70 times those in 2020 (which were just over $20 million). The decline in value was much greater for art-related NFTs than other segments, and they accounted for just 8 percent of the value of NFT sales on the Ethereum network in 2022 (versus 67 percent for collectibles-based NFTs). With less focus on booming prices and speculation, the debate has shifted to the longer-term impact of blockchain applications in the art market, according to the report, which can be downloaded via Art Basel’s website.